The Credit Secrets Book Review for 2024

Today, I want to share my review of the Credit Secrets book, which will allow you to get your credit scores back on track and help you with your financial future. Credit is increasingly vital in determining our economic opportunities and overall financial well-being. A good credit score can open doors, such as lower interest rates on loans and better terms on credit cards. In contrast, a poor credit score can hinder our ability to achieve our financial goals, often requiring us to spend more on interest payments or insurance rates than we want. Understanding and managing credit can be daunting for many people, and that’s where “Credit Secrets” by Scott and Alison Hilton comes in. You are here to get answers, so let’s hurry and give you some!

What Is Credit Secrets, and Why Do I Care?

“Credit Secrets” is a comprehensive guide that aims to help readers take control of their credit scores and improve their financial situations. The authors, Scott and Alison Hilton, share their personal experiences, insights, step-by-step instructions, and expert advice. In this review, I’m sharing my thoughts on the book, discussing its key takeaways, and explaining why I believe it’s a valuable resource for anyone looking to improve their credit and attain financial freedom.

The Emotional Financial Journey

One of the most compelling aspects of Credit Secrets is the emotional journey of the authors. Scott and Alison Hilton found themselves drowning in debt and struggling with poor credit scores, which negatively impacted their lives. Through extensive research and trial and error, they were able to turn their financial situation around and significantly improve their credit scores. Their personal story is inspiring and adds a sense of authenticity to the book, as the authors can speak from first-hand experience and genuinely understand the challenges faced by those in similar situations. Credit Secrets puts credit reports and scores back under your control. The book teaches you all about breaking the rules of the game and convincing creditors that having nothing to do with you is in both of your best interests.

We All Know It: Poor Credit Is like a Knife in Your Side! If you want to take out a loan or need it to buy your own house, moneylenders keep treating you like a criminal! A better credit score could help, but how exactly do you get there? A few years ago, I was in that boat myself. I was trying to get financing for a work van, but my credit score was slightly above 500. After trying to reason with three loan sharks, all of which asked for interest up to 15% for a vehicle worth a mere $12,000, I was left with no options. I needed to escape that situation, so I used my brain. I found Credit Secrets, followed all the techniques to the letter, and finally got out of the proverbial sand pit! I won’t lie; it felt great! In only a handful of months, my credit score skyrocketed. From the beginning of 2019, I’ve been at a solid 804; in the past three years, I’ve never dropped below the 790s. I understand your skepticism; credit repair companies have scammed you before. You’ve tried to beg and plead with the credit bureaus. And nothing has ever worked. Well, Credit Secrets is going to change all that.

How Long Will It Take to Rebuild Your Credit Score?

That depends on your situation! For some, one day is more than enough; more challenging situations will take longer. On average, most members see the first score jumps in about 30 days! If you are using Credit Secrets to rebuild your credit score, you may wonder how long it will take to see results. While the answer varies depending on your circumstances, Credit Secrets can help you achieve your goals more quickly by providing practical strategies and techniques for improving your credit. One of the key advantages of Credit Secrets is that it focuses on the most effective strategy for improving your credit score quickly. You may start to see improvements in your credit score by addressing inaccuracies on your credit report, negotiating with creditors, and building positive credit habits within months. The program offers specific strategies for managing different types of negative marks on your credit report. For example, if you have collections accounts or charge-offs, Credit Secrets provides a step-by-step process for negotiating with creditors to settle your debts and remove these negative marks from your credit report. Credit Secrets also provides strategies for building positive credit habits, such as making on-time payments and lowering your credit utilization. These habits can help improve your credit score over time, and Credit Secrets guides you in how to incorporate them into your financial routine. While the exact timeline for rebuilding your credit score with Credit Secrets will vary depending on your circumstances, the program was created to help you achieve your goals more quickly and effectively than if you were to try to repair your credit on your own. Rebuilding your credit score with Credit Secrets is an effective option for anyone who wants to take control of their finances and improve their credit score.

Why Is It Important to Raise Your Credit Score?

Your credit score is one of the most important factors regarding your financial health. A high credit score can help you access better credit cards, lower interest rates on loans and mortgages, and even improve your job prospects. On the other hand, a low credit score can make it challenging to obtain credit, and you may end up paying higher interest rates and fees. This is why taking steps to increase your credit score is essential, and Credit Secrets can help.

How Credit Secrets Helps Raise Your Credit Score

Credit Secrets provides a range of strategies and techniques to help you increase your credit score. Here are a few ways the program can help:

- Dispute inaccuracies on your credit report: One of the most effective ways to improve your credit score is to dispute inaccuracies on your credit report. Credit Secrets provides a step-by-step guide to help you identify and dispute errors on your credit report, which can significantly increase your credit score.

- Negotiate with creditors:Credit Secrets provides tips and strategies for negotiating with creditors to settle debts and remove negative items from your credit report. This can help improve your credit score and make it easier to access credit in the future.

- Build credit: Credit Secrets offers advice on how to build credit, including tips on using credit cards responsibly and strategies for establishing a positive credit history. Following these strategies may increase your credit score and improve your financial health.

Credit Secrets is an excellent resource for anyone who wants to improve their credit score and achieve financial freedom. The program offers a wealth of strategies and techniques that can help you take control of your finances and increase your credit score. With its focus on actionable advice, affordability, and ease of use, Credit Secrets is a top choice for anyone who wants to take control of their credit score and achieve their financial goals.

Does DIY Credit Repair Really Work?

The idea of repairing your credit yourself may seem daunting, but the truth is that DIY credit repair can be incredibly effective. With the right resources and tools, anyone can take steps to improve their credit score and take control of their financial future. Credit Secrets is a program that is created to help you achieve these goals by providing actionable advice and strategies for DIY credit repair.

The Benefits of DIY Credit Repair

Here are a few reasons why DIY credit repair can be an effective option:

- Cost-effective: Hiring a credit repair company can be expensive, and many of these companies make promises they can’t deliver. With DIY credit repair, you can save money and control the process.

- Better understanding of your credit: When you take control of your credit repair, you gain a better understanding of your credit report, how it impacts your credit score, and what you can do to improve it. This knowledge can be incredibly empowering and help you make informed financial decisions.

- Flexibility: With DIY credit repair, you can work at your own pace and address the specific issues impacting your credit score. You don’t have to rely on a third-party company to decide your credit scores.

How Credit Secrets Can Help with DIY CreditRepair

Credit Secrets provides a comprehensive guide to DIY credit repair, offering strategies and techniques that have been shown to work. The program offers step-by-step instructions for disputing inaccuracies on your credit report, negotiating with creditors, and building credit. By following these strategies, you can take control of your credit score and achieve financial freedom. DIY credit repair does work, and Credit Secrets is an excellent resource for anyone who wants to take control of their credit score and improve their financial health. With its affordable price point, easy-to-follow instructions, and wealth of strategies and techniques, Credit Secrets is an excellent choice for anyone who wants to achieve their financial goals and improve their credit score.

What’s All This Chatter About the 11 Secret Words or “The Credit Maximizer”?

You’ll have to read the book to find that out. Sorry. It works wonderfully!

Is Credit Secrets a Scam?

With so many scams and fraudulent programs out there promising to improve your credit score, it’s understandable to be skeptical of any new program that comes along. However, Credit Secrets is a legitimate program that has helped many people improve their credit scores and take control of their finances. Credit Secrets was created by Scott and Alison Hilton, who have a proven track record of success in the financial industry. They have helped countless people improve their credit scores and achieve financial freedom and are highly respected within the industry. One key factor that sets Credit Secrets apart from other credit repair programs is its focus on using legal and ethical strategies to improve your credit score. The program is not a quick fix or a magic solution but a comprehensive system that provides practical tools and strategies for repairing your credit and building a solid financial foundation. A 100% satisfaction guarantee also backs Credit Secrets, so you can try the program and see for yourself whether it works for you. If unsatisfied with the program, you can get a full refund within 90 days of purchase, no questions asked. It’s important to note that Credit Secrets is not a one-size-fits-all solution. The program provides general guidance.

The Credit Secrets Book Has Three Main Sections

This book is well-written and extremely simple to read. When one follows the advice in the book, the methods and loopholes outlined in it may help you finally achieve the credit scores you desire. Banks and credit institutions can do NOTHING to stop you!

1. The Basics: Understanding Credit and Credit Scores

In the first section, “The Basics: Understanding Credit and Credit Scores,” the authors provide an easy-to-understand introduction to credit, credit scores, and credit reports. They explain how credit scores are calculated, the factors influencing them, and why maintaining a good credit score is essential. This section lays a solid foundation for the rest of the book, ensuring readers understand the critical concepts clearly before diving into more advanced topics.

2. Repairing and Improving Your Credit

The second section, “Repairing and Improving Your Credit,” is the heart of the book. Here, the authors delve into the nitty-gritty of credit repair, providing readers with practical, actionable steps to take control of their credit scores. This section covers disputing errors on credit reports, negotiating with creditors, dealing with collections, and understanding the impact of bankruptcy and other financial setbacks. The authors also provide tips on rebuilding credit, such as obtaining secured credit cards and responsibly managing credit utilization. Throughout this section, Scott and Alison Hilton’s experiences are interwoven with expert advice, making for an engaging and informative read.

3. Advanced Credit Strategies

In the final section, “Advanced Credit Strategies,” the authors take things up a notch by sharing their insights on more advanced credit management techniques. This section covers topics like credit piggybacking, using credit-builder loans, and maximizing credit card rewards. The authors also guide on maintaining good credit and preparing for significant financial events, such as buying a home or starting a business. What sets Credit Secrets apart is the authors’ clear, conversational writing style and ability to break down complex financial concepts into easily digestible language. The book is accessible to readers of all financial literacy levels. By weaving their journey throughout the book, Scott and Alison Hilton create a sense of authenticity and relatability that resonates with readers facing similar challenges.

OPTIONAL Upgrade: A VIP Facebook Group for Coaching!

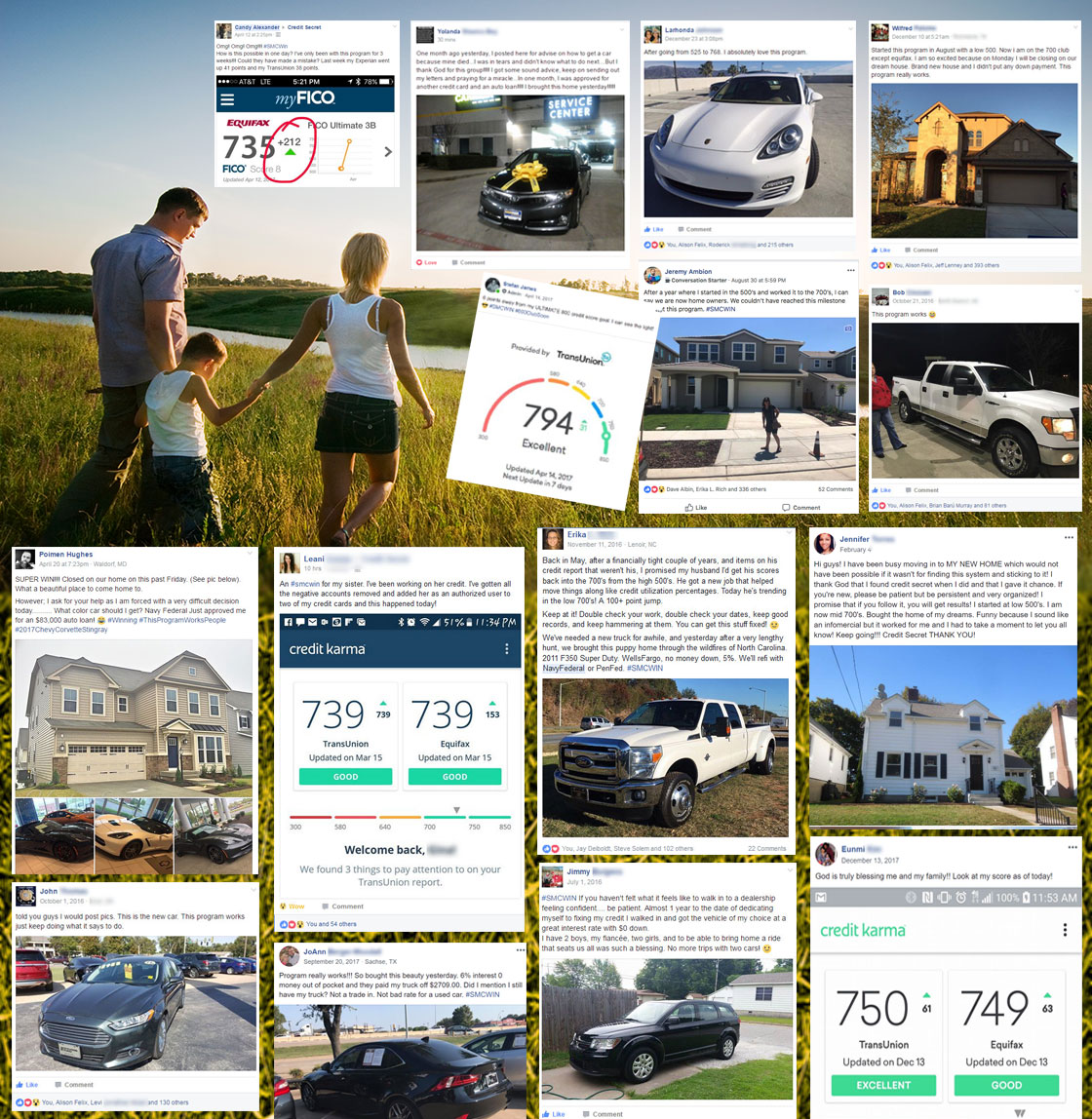

This private, members’ only VIP Group is the BEST value for any dime you’ll spend repairing your credit. At the time of this review, there were over 25,000 real people using the Facebook group to share tips, get ideas, and cheer each other on as they reached their goals!

Take a moment to check out the testimonials above. These are 100% actual posts straight from the VIP group on Facebook. My Advice: What are you waiting for? Get your copy NOW, follow the instructions for at least 30-60 days (some techniques take time!), and I know you won’t regret your purchase!

In summary, “Credit Secrets” by Scott and Alison Hilton is a valuable resource for anyone looking to improve their credit and attain financial freedom. Through their personal experiences, expert advice, and step-by-step guidance, the authors provide readers with the tools and knowledge needed to transform their financial lives and unlock countless opportunities.